Better to buy than rent in Reykjavik

It is better to buy a flat in Reykjavik than to rent, according to new data from Icelandic bank Landsbanki.

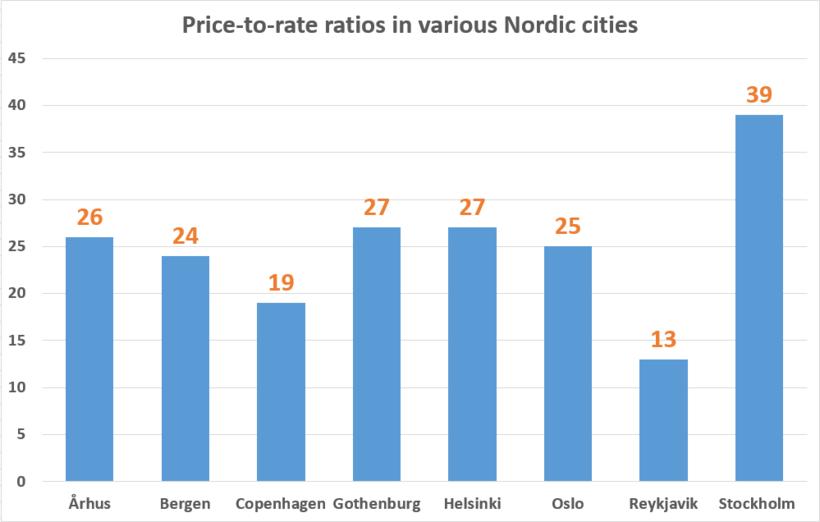

In a recent report (in Icelandic, see here), Landsbanki looks at the ‘price-to-rent ratio’ for Iceland’s capital city, i.e. the ratio of purchase list price to yearly rent.

According to data from Registers Iceland, an average 100 m2 flat in Reykjavik currently costs ISK 32 million (approx. €218,000) to buy. Renting the same flat would cost ISK 200,000 a month, i.e. ISK 2,400,000 per year.

The price-to-rent ratio for Reykjavik is therefore calculated as 32,000,000 / 2,400,000 ≈ 13. It would therefore take thirteen years of renting to pay the full list price of the property.

Markets with price-to-rent ratios below 15 are generally classified as ‘much better to buy than rent’ markets.

As a comparison, the ratio for Stockholm is 39, i.e. rents are lower in Stockholm (proportionally, as compared to the list price) to such an extent than it would take a tenant there three times longer to pay the full list price in rental payments than a tenant in Reykjavik.

The report admits that this “simple example […] does not take other cost items into account”, but maintains that it “nevertheless clearly points towards the fact that it is proportionally unfavourable to rent a flat in Reykjavik, given purchase prices”.

The only period during which it was more favourable to rent in Reykjavik than to buy was 2005-08, reads the Landsbanki report.