Central Bank cuts key interest rate to 7.5% amid inflation concerns

The Monetary Policy Committee (MPC) of the Central Bank of Iceland has lowered the bank’s key interest rate by 0.25 percentage points, setting the seven-day term deposit rate at 7.50%. This marks the fourth consecutive rate cut, with unanimous support from all committee members.

While Landsbanki and Íslandsbanki had forecast the rate would remain unchanged, Arion Bank correctly anticipated the 0.25-point reduction.

Inflation steady but still elevated

According to the MPC’s statement, inflation measured 4.2% in April, significantly below its peak two years ago. The Central Bank’s latest forecast predicts that inflation will hover around 4% through year-end, before gradually approaching the 2.5% target. However, the Bank emphasized ongoing uncertainty in the inflation outlook, especially due to recent global economic developments.

Economy still showing strength

The Bank noted that while domestic demand growth has slowed under tighter monetary conditions, there are still signs of resilient economic activity. This includes strong card turnover figures, rising wage costs, and inflation expectations that, though down from earlier highs, remain above the target.

Updated Interest Rate Structure

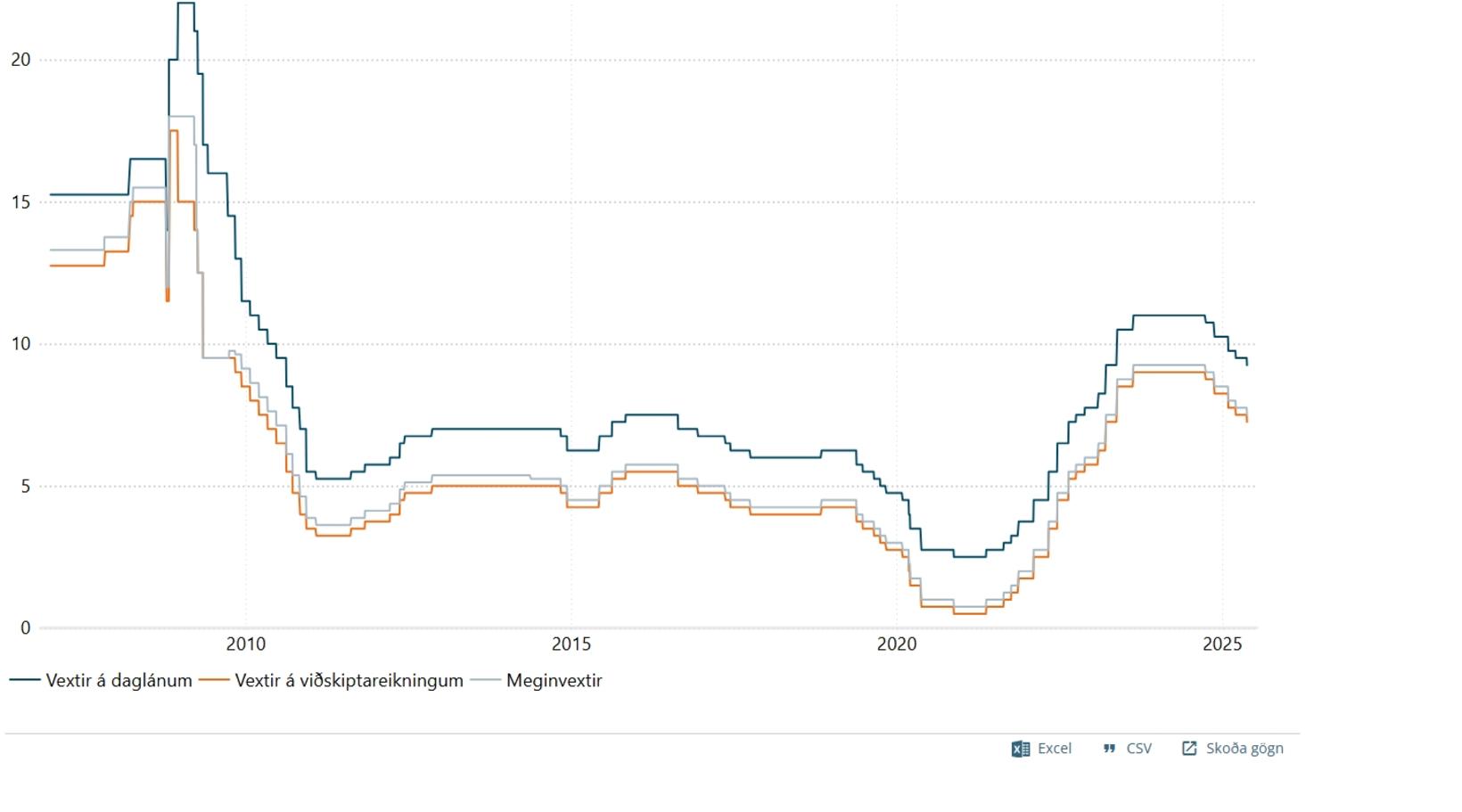

Following the decision, the Central Bank’s interest rates are now:

- Overnight lending rate: 9.25%

- 7-day collateralized lending rate: 8.25%

- 7-day term deposit rate (main rate): 7.50%

- Current account rate: 7.25%

While the Bank continues to emphasize its commitment to price stability, future rate moves will likely depend on whether inflation declines more significantly in the coming months.

Intererest rate cuts likely on hold as inflation persists

The Central Bank of Iceland has signaled that further interest rate cuts are unlikely unless inflation declines more significantly.

In the MPC’s statement this morning, the Bank forecasted that inflation would remain around 4% through the end of the year — suggesting the current easing cycle may have reached its limit, at least in the short term.

Central bank criticism of price behavior

At the committee’s press conference, Central Bank Governor Ásgeir Jónsson criticized the domestic pricing environment, highlighting factors that should have led to lower inflation but haven’t. These include a stronger króna, declining global oil prices, and a cooling housing market — none of which, he noted, have been reflected in retail prices.

He also warned that rising wages — with average increases exceeding 8% year-on-year in the first quarter — were being passed directly to consumers through higher prices.

“A very clear message”

Deputy Governor Þórarinn G. Pétursson emphasized that the bar for further interest rate cuts is now high. “We have just reached a point where we will not move further with interest rates until we get inflation down much more,” he said, suggesting that inflation must fall closer to 3% before easing continues. “I think this is a very clear message.”

Updated inflation forecast

The Central Bank’s updated forecast, published in the Monetary Bulletin, expects:

- 2024 : Inflation to remain at 4% year-end, with a 4% annual average.

- 2025 : A gradual decline, reaching 9% by year-end and 3.3% on average.

- 2027 : Inflation aligning with the Bank’s target of 5% on average.

Unless inflation trends downward faster than anticipated, today’s modest rate cut could mark the final step in the Bank’s current monetary easing strategy.

/frimg/1/58/37/1583777.jpg)