Gasoline in Iceland is expensive and 53% goes to the state

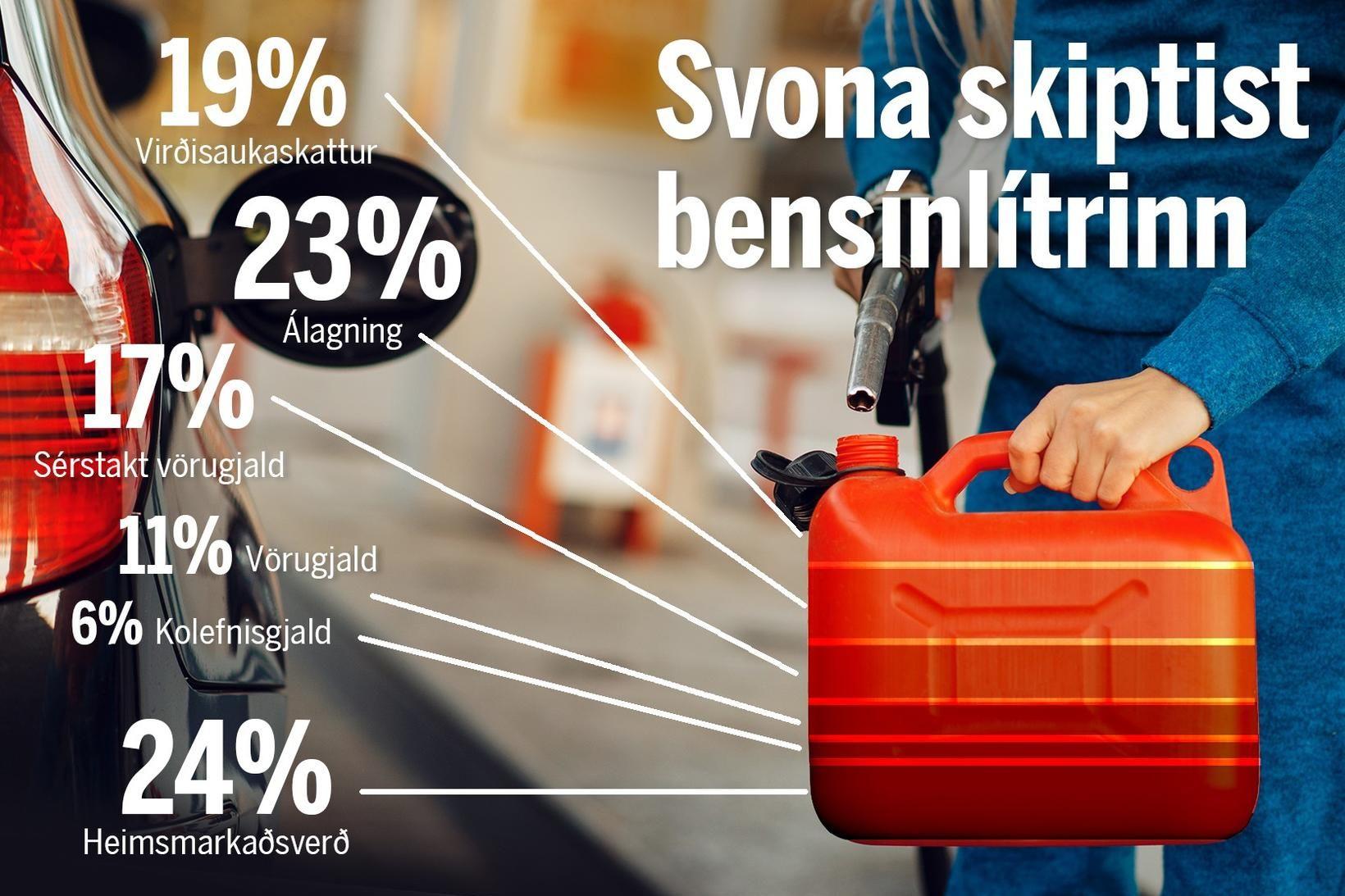

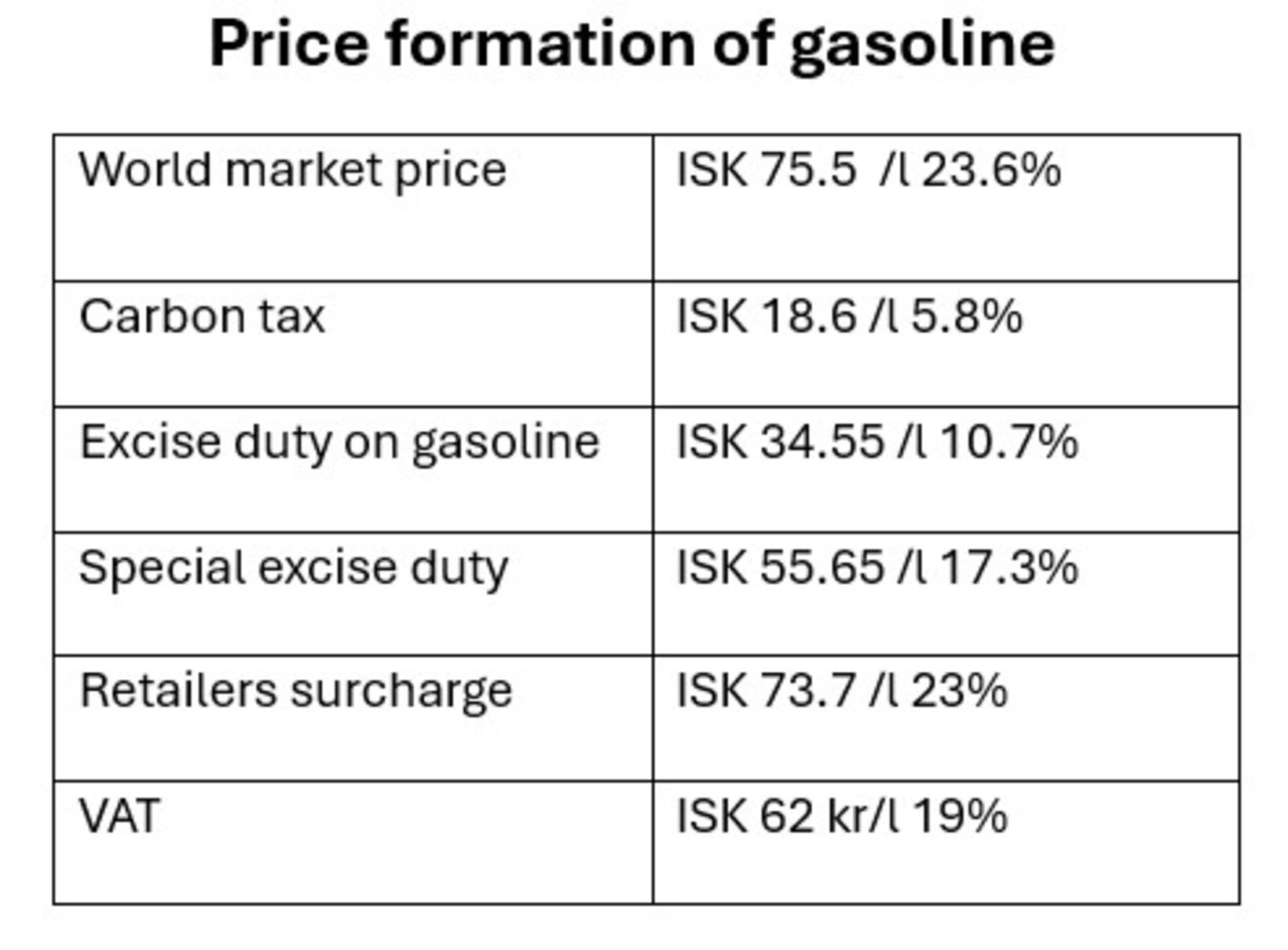

Here is the breakdown of the cost of a liter of gasoline priced at ISK 320: VAT 19%; Retailer's surcharge 23%; Special excise duty 17%; Excise duty on gasoline 11%; Carbon tax 6%; World Market Price 24%.

The CEO of Skeljungur in Iceland says high taxes are the main reason why fuel prices are currently the third highest in the world.

For example, the carbon tax, which was increased by 59% at the beginning of the year, has already been directly reflected in prices.

This increased all fuels by approximately ISK 10 per liter sold in the country.

Roughly speaking, about ISK 170 of every liter of gasoline sold goes to the state if we consider the most common price of gasoline in Iceland, which is about ISK 320, or about 53% of the total price. Two years ago, the percentage was 49.7%.

The situation is similar when it comes to the price of diesel, where the percentage is roughly just under ISK 170, which goes to the state.

Only Hong Kong and Monaco have higher prices

At the end of December, the price of a liter of gasoline was only higher than in Iceland in two countries in the world, Monaco and Hong Kong, according to a summary on the website GlobalPetrolPrices.com, which monitors fuel prices in 168 countries.

The price of a liter of diesel is also higher only in Hong Kong than in Iceland.

Þórður Guðjónsson, CEO of Skeljungur, which is responsible for the distribution but not the retail sale of fuel, says that everything indicates that the 59% increase in the carbon tax at the beginning of the year has been directly reflected in prices. Thus, the most common price has increased from ISK 310 to ISK 320 krónur per pallet at the beginning of the year, as can be seen on the consumer advocate website, gasvaktin.is .

Costco sells the cheapest fuel in the country. For example, the price of gasoline went from ISK 266 to ISK 276 krónur with the increase in the carbon tax.

The common price at selected locations of the other oil companies is around ISK 291-292, based on the price monitoring Gsmbensin.is .

However, such a price is only found in the capital area.

High taxes are the main culprit

“There are many things that explain gasoline prices in Iceland. We are a remote island in the north of the Atlantic Ocean and in a large, densely populated country. But by far the biggest explanation is high taxes, which are more than half of the fuel price. Those taxes are linked to the Icelandic króna number with a value-added tax that is added on top when the fuel is sold to consumers,” Guðjónsson says, when asked why Iceland has the third highest fuel price in the world.

Despite the recent increase in gasoline prices in Iceland, world market prices have remained relatively stable over the past year.

The world market price of oil is 723 dollars per ton for gasoline, but 690 dollars for diesel. It is therefore likely that the world market price per liter of gasoline is more than ISK 75, while diesel is about ISK 70.

Fees, surcharges and taxes

Fuel prices depend on several factors: surcharges, taxes, fees, and purchase prices. According to Guðjónsson, Skeljungur, for example, buys fuel from the Norwegian state-owned company Equinor with a surcharge above the world market price, insignificant port fees are paid when supplies arrive in the country, then there is the carbon tax, excise duty and a special excise duty on gasoline. Then comes the retailer's surcharge and finally a value-added tax of 24% is added to the fuel price when the consumer pumps the fuel into the car.

The state's share when it comes to diesel fuel is called the carbon and oil tax, in addition to value-added tax and follows the same principles as the above-mentioned pricing.

Added to this are obligations from the Icelandic Energy Agency and the Environment Agency that the fuel contains additives that make gasoline more expensive to produce but more environmentally friendly at the same time, according to Guðjónsson.

Fuel quadruples in price

When looking at the breakdown of a liter of gasoline by ISK, and if we consider the most common price of ISK 320, the ISK figure is divided as follows:

World Market Price quadrupled

It should be noted that the króna figures change if gasoline is purchased at gas stations that sell cheaper gasoline. It is noteworthy that if we consider the most common price of fuel, the world market price has more than quadrupled by the time it reaches the vehicle.

Substantial tax increases

There have been substantial increases in taxes on gasoline in recent years.

The carbon tax has increased by 86% since 2020, the excise tax on gasoline by 20%, and the special excise tax on gasoline by 20%. At the same time, prices have increased by 35.6% if we consider the period January 2020 to December 2024.

The carbon tax on diesel fuel has also increased by 86%, while the oil tax has increased by 20% since 2020.

/frimg/1/57/87/1578747.jpg)