Prices might continue going down

A lot of new constructions is going on in the capital area but the Central Banks has voiced concern that the supply will outdo the demand in this market of high inflation and interest rates. mbl.is/Kristinn Magnússon

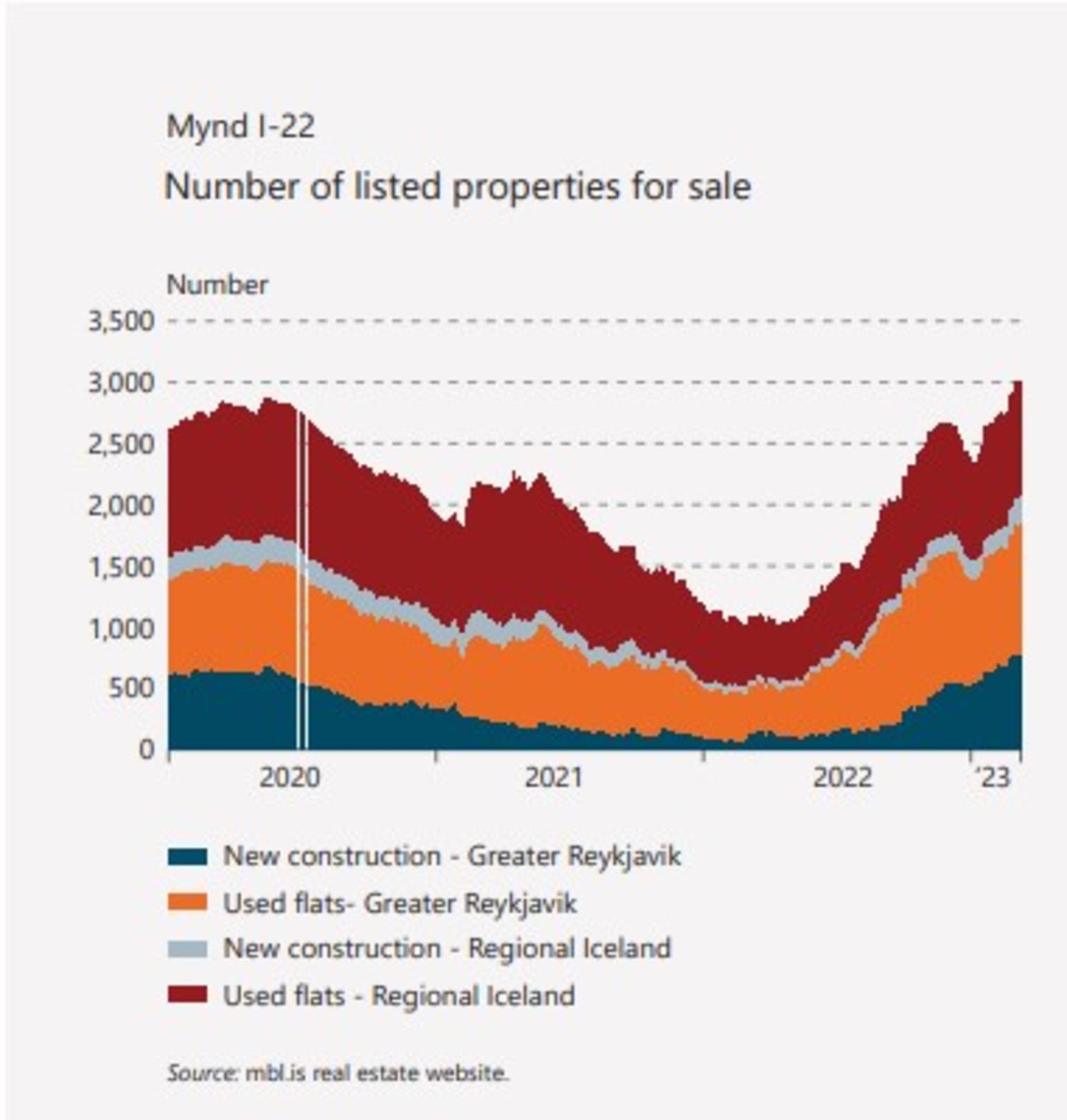

More apartments are now being advertised for sale than a year ago and an increased rate of apartments sells at a discounted price and there has been a real fall in the price of apartments. The interest rate environment and inflation also make it more difficult for people to finance apartment purchases than before, but at the same time it looks like a significant number of apartments will be on the market this year and next.

If inflation persists with the associated level of interest rates, the likelihood that demand for apartments will remain low is that supply could be somewhat outstripped by the demand with the consequent pressure to reduce the price of apartments.

This is among the findings of the Financial Stability, a publication of the Central Bank issued today, presented by Haukur C. Benediktsson, the managing director of the Financial Stability Authority.

The report states that in early March, there were over 750 new buildings for sale, while there were 100 for sale at the same time last year. The increase is partly explained by the fact that contractors are now putting apartments up for sale earlier than before with delivery times of up to a year, even well over 12 months in some cases.

Rising interest rates, tighter credit conditions and large increases over the underlying factors have reduced market demand, and purchase contracts at the start of the year were 30% fewer than at the same time last year.

Housing prices peaked in June

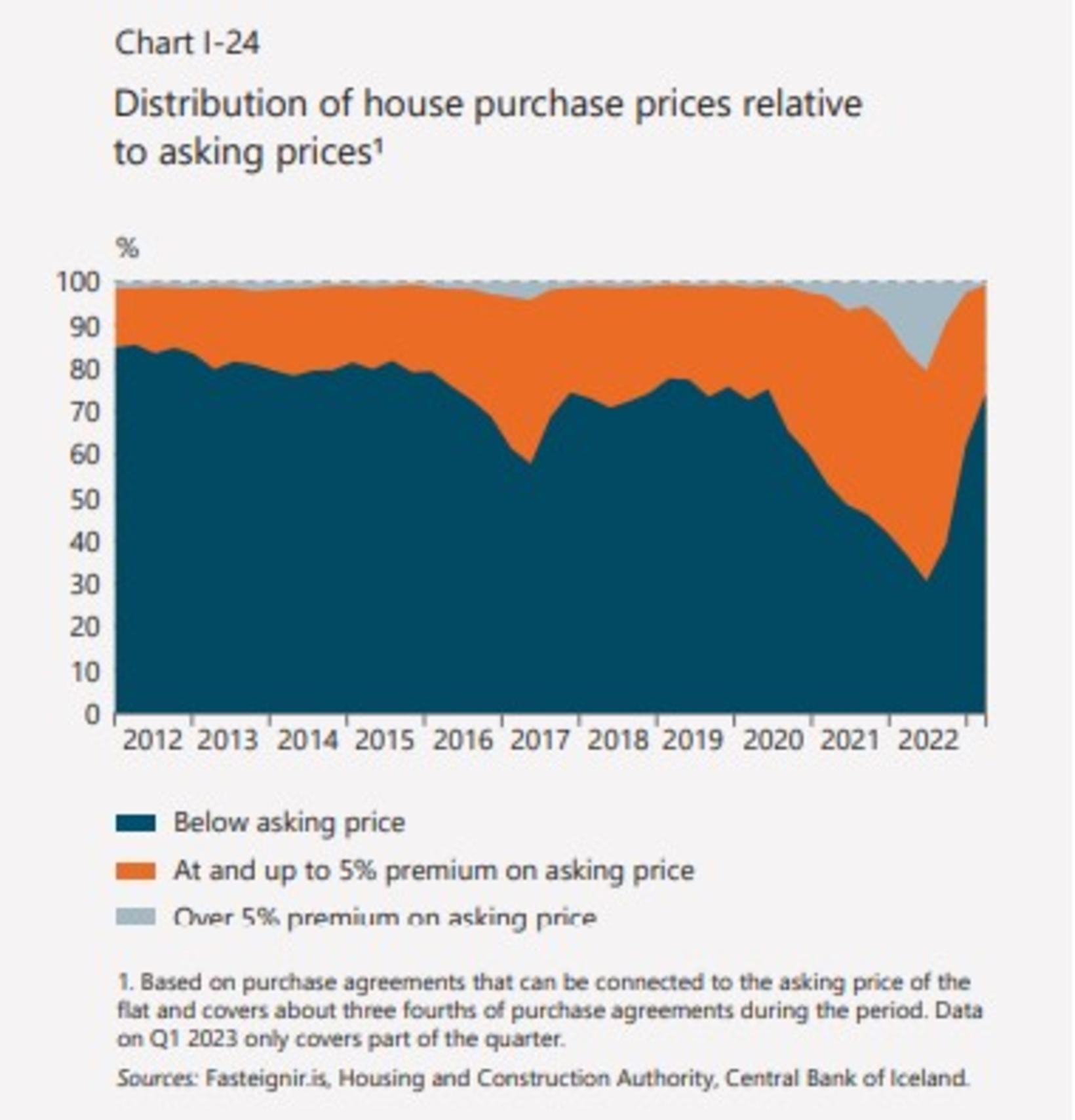

The Central bank points out that this is evident when looking at the proportion of apartments sold below or above the target price. Thus, the proportion of apartments selling below the target price has returned to a more normal level than in previous two years. The proportion of apartments selling below the target price has consistently been about 75% of all purchase agreements, but this was at its lowest point down to about 30% around the middle of last year.

On the other hand, the proportion of apartments that were sold at a premium of 5% over asking price or more rose to 19% during this time, but has now dropped a lot and is in a similar place to what it had been before, at 1%.

Even so, house prices peaked in real terms last June. The price of housing in the capital area has dropped by 3.4% since.

One of the benchmarks the Bank is looking at is the deviation of house prices from long-term trends. That rate peaked in June last year, with 19.1% above the long-term trend. It has fallen, but was still 13.2% in January.

Sharp decline abroad

The Central bank refers to the fact that there has been a sharp fall in property prices in many other countries. In particular, the trend is said to have been rapid in Sweden. There, the real price of apartments rose by almost 18% from January 2020 to February 2022.

However, from that time until January this year, the real price decrease was 23% and the real property price in Sweden has not been lower since mid-2015.

Housing prices in Canada and the United States peaked in April and May 2022, but have since been declining. In Canada, real house prices have fallen by more than 11%, while the real price of apartments has fallen by more than 7% in the United States based on the latest data.

More than 2,100 housing units per year for the next two years

But if we turn our eyes back to Iceland and the number of apartments finished building, the number of apartments that were completed decreased somewhat in the last year. That was 1,600 after 2,200 in 2021. The average number of completed apartments has been more than 2,000 per year since 2019, but if you look at the period 2008-2018, the number was only 940.

According to a recent forecast by the Housing and Infrastructure Agency, over 4,300 new apartments are expected to be completed in the next two years, or over 2,100 apartments each year. The Central Bank states that most of the housing markets indicate that there is considerable tension in the construction market, thus referring to the fact that the job vacancy rate in the construction industry was around 1,500 in the last quarter, or over 8% of the total number of people employed in the industry. In spite of this, the number of construction workers had increased by 14% year-on-year.

The construction market still very active

The Central Bank’s summary also states that imports of timber and cast iron have been at their highest level despite recent price fluctuations and that there is no reversal there based on the latest figures. Benediktsson’s case this morning also stated that lending to the construction sector in January increased by 21% in real terms over a 12-month period, which shows the expansion taking place in this market.

Chance of continued price decline

Taken together, the Central Bank says that increased supply down to persistent inflation and higher interest rates are expected to hit property market prices.

“The construction sector takes a considerable amount of time to respond to the change in residential demand. If inflation persists in the coming seasons and therefore the interest rates are generally higher than they would otherwise be, the demand for apartments will likely remain substantially lower than in the last two years. The increased supply of new buildings in the next two years could be somewhat in excess of the demand with the consequent pressure to lower the price of apartments,” the publication stated.

/frimg/1/57/87/1578747.jpg)

/frimg/1/57/94/1579405.jpg)