Scammers trying to get ID information

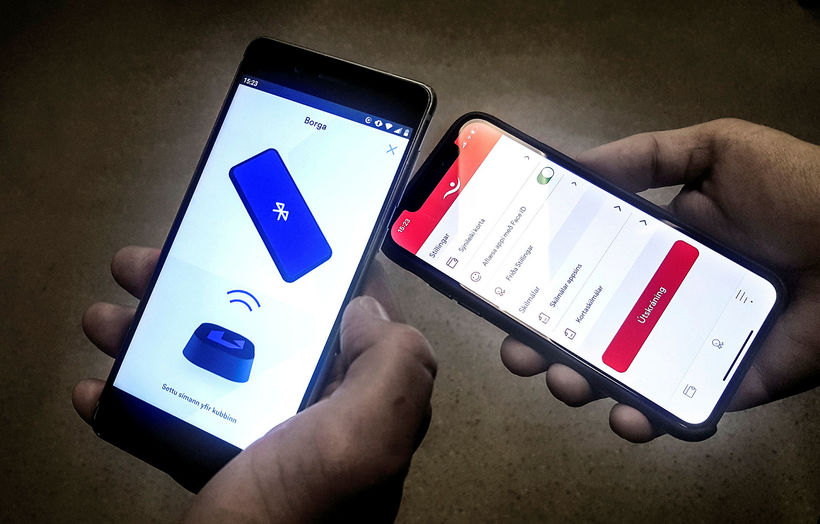

Phone apps. Direct payments by phone still make it easier for consumers to access banking services. Security improves if biometric identifiers are used. mbl.is/Eggert Jóhannesson

The Computer Emergency Response Team of Iceland, CERT-IS, believes there is reason to warn against fraudulent calls which have the aim of tricking victims into authorizing a home bank account with electronic ID.

This is confirmed by Guðmundur Arnar Sigmundsson, director of CERT-IS, in a conversation with mbl.is.

Sigmundsson says that most of the phone calls were made about a month ago. There weren’t many phone calls, but the these kind of scams are well known abroad.

International crime groups

“It’s coming up in cycles,” he says. “It’s been almost a month since there was a steep rise in these phone calls.”

Sigmundsson says that there are international criminal groups that attack different areas. Phone companies try to block out such calls, but there are always some people who break through.

“This is a similar kind of fraud as when you receive fraudulent texts and fraudulent emails. The goal is the same, to try to trick people into giving their ID information.”

The number seems Icelandic at a glance

When asked what people need to be wary of, Sigmundsson says that the phone calls are foreign but seem Icelandic looking at them in a glance.

The numbers have the prefix +1 354, which confuses many people in the world, as +354 is Iceland’s national number. However, +1 is, in contrast, the national number of the United States.

Sigmundsson says that it is common for a caller to speak very good and convincing English, saying that he or she is either new to the bank, a service provider or a remote worker.

The untrustworthy parties then pay the victims to authorize a home-banking login with electronic ID. When the login is authorized, almost immediately, the person tries to use debit the credit card of the unsuspecting victim.

Cannot log in again and again

He says that the fraudulent phone call doesn't steal the identification. The victim needs to re-identify and re-identify again so the thieves can break into their account again.

“If I were to give you my password right now, you could always log into my home-bank. But because we have dual-identification and electronic ID, I always have to answer the application or phone every time you log in.”

According to Sigmundsson, it is important to be wary and react quickly if there is suspicion that fraud has occurred. It is important to contact the bank and close the card. Guðmundur also points to the website of CERT-IS where people can seek further information.